Enabling Cryptocurrency Bill Payment

Spritz

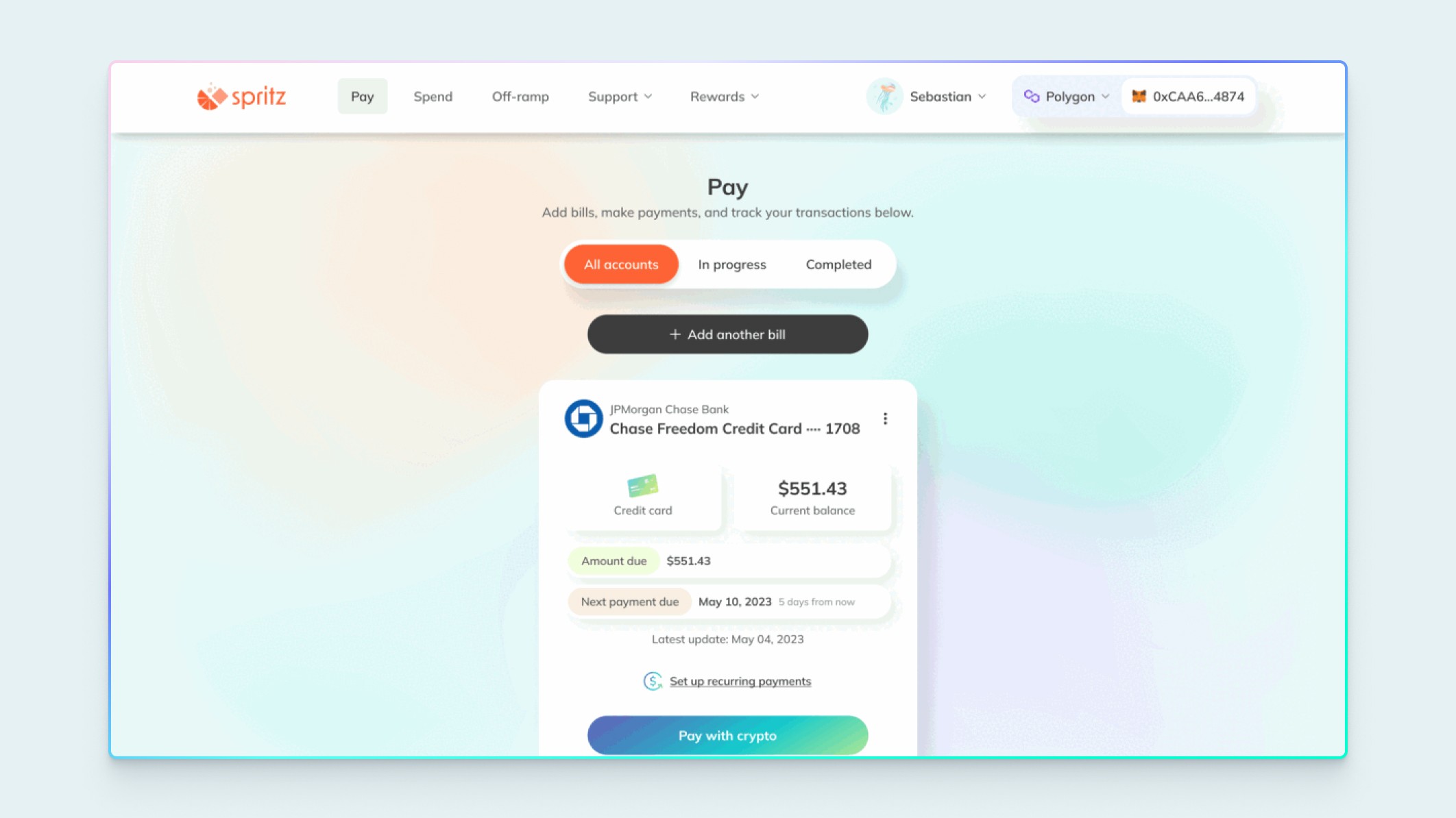

Spritz Finance enables bill-pay for decentralized finance users directly through their crypto wallets with no bank required.

Industry

Personal Finance

Website

Products used

Connect

Data

Pay

Number of employees

11-50

The Challenge

Automated payments can improve consumer financial health, providing a convenient, secure way for users to pay their bills on time, avoid debt, and boost their credit score. Spritz Finance takes this a step further by allowing users to pay bills using cryptocurrency and their on-chain earnings through DeFi.

While developing the initial version of the product, Spritz soon discovered challenges integrating and retrieving customer balance data and other liabilities. Automating bill pay posed some key challenges:

Linking users’ bills & debt accounts. Previously, users had to connect each of their individual financial accounts using a tedious credential-authorization method. In other words, they had to log into each one of their accounts to view balances and payment dates. Not only was this time-consuming for the user, but it made for a poor user experience leading to drop off and account connectability issues.

Necessary banking partner agreement. Spritz would need to acquire a standard banking partner agreement, set up FBO accounts and perform KYC verification for all users. This would shift the product launch timeline several months, hindering growth.

Lengthy infrastructure building. Developing the foundation needed to push money into a user’s account from each financial institution can be a lengthy and laborious process. Setting up these relationships and maintaining them requires a full team, increasing overhead costs.

Method’s payment solution allowed Spritz to easily authenticate users and provide end-to-end digital payment options, helping users pay off their bills using cryptocurrency.

– Chris Sheehan, Spritz CEO

The Solution

Spritz spoke with a range of vendors in the market but felt that Method was the only one able to provide a seamless user debt stack view, authenticated with just the user’s phone number. Additionally, the Payments API provided true end-to-end digital payment orchestration without requiring any additional user input.

Method allowed Spritz to retrieve all of a user’s existing liabilities using just the customer’s name and phone number. By connecting the company directly with top financial institutions, Spritz could retrieve real-time data straight from the source. Method continuously monitors for new user debts, notifying Spritz when new liabilities appear. In addition, Method provides on-demand access and nightly updates.

Method’s value proposition of a turn-key solution was straightforward. Method’s Payments API:

Simple debt-linking UX. Method retrieved all bills and liabilities with just a user's phone number.

Real time data & continuous access. Method retrieves real-time data, including payoff amounts, due dates, and credit type, and notifies automatically when new bills or debts appear.

Self-driving money. Intelligently pay recurring bills on behalf of users at 5,000+ financial institutions, managing KYC with instant payment confirmation.

The quick integration allowed Spritz Finance to provide a uniform seamless experience for easy and secure bill payment using digital assets and on-chain earnings.

About Spritz Finance

Spritz Finance enables bill-pay for decentralized finance users directly through their crypto wallets and with no bank required. Their goal is to connect TradFi to DeFi, making it easy to program crypto payments for real-world bills, from mortgage payments to credit card bills, and allowing users to automate their personal finances using their on-chain assets. Spritz Finance lets users choose how to fund payments, link their existing cryptocurrency wallets, and integrate all their bills seamlessly. To learn more, visit spritz.finance.

About Method Financial

Method’s APIs are redefining financial connectivity with real-time, read-write, and frictionless access to all consumer liability data with integrated payment rails. Method helps lenders increase revenue by streamlining customer acquisition, improving underwriting accuracy, and increasing line utilization through balance transfers, all without the need for a consumer’s username and password. Today, Method powers solutions for over 60 fintechs, lenders, and FIs including Aven, Bilt, Upgrade, and Figure. Method is backed by a16z, Abstract Ventures, YC, Truist Ventures, and more. To learn more, visit methodfi.com.