The future of financial account connectivity

Method provides connectivity to consumer credit and liability accounts with embedded payments, enabling end-to-end lending experiences, real-time account data intelligence and one-click checkout.

Instantly connect financial

accounts with a single auth

Link your users’ credit and liability accounts utilizing multi-factor authentication—no login credentials required.

One Auth

Verify and connect your user’s credit and liability accounts across 10,000+ FIs with just their phone.

Stable connectivity

Reduce security overhead

Never collect sensitive credentials or account information with Method handling data security and privacy compliance.

Complete Coverage

Access every financial account including student loans, credit cards, personal loans, auto loans, and more with a single auth.

Comprehensive, Real-Time Data

Instant Alerts and Attributes

Receive push notifications for balance changes, new accounts, delinquency, and 300+ other data points.

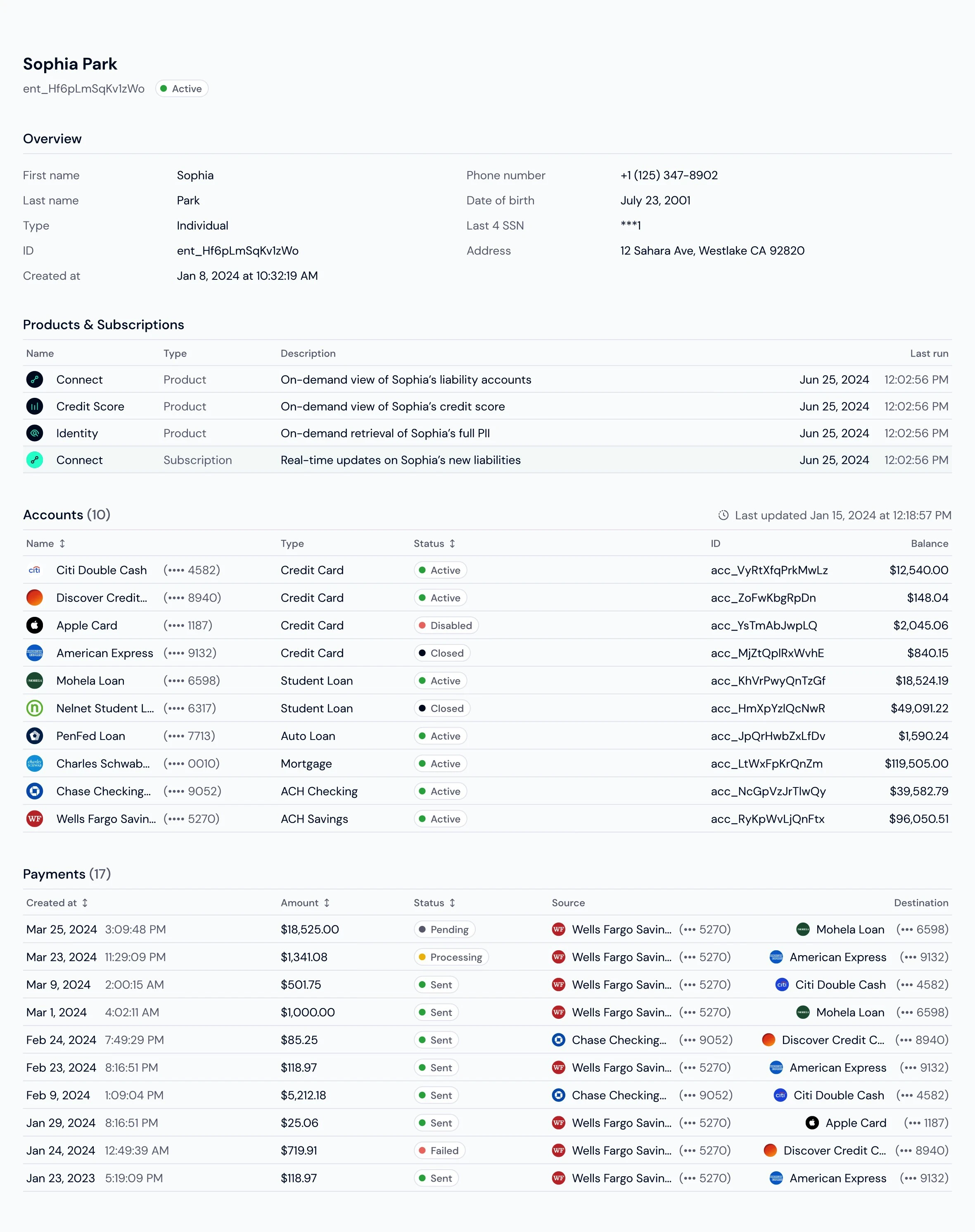

A powerful view for your entire team

Get started instantly with a dashboard that unlocks the full power of our API for your team—onboard users, pay off balances, reconcile accounts, and more.

Robust access control

No-code API access

Extensive reporting

Method in the news

Method is making headlines. Read about our latest achievements, news features, and industry insights.