Launching Automatic Debt Payoff: What Ditch Built with Method

Ditch

Ditch is the first consumer AI app built to automate debt freedom.

Industry

Personal Finance

Website

Products used

Connect

Data

Pay

Number of employees

2-10

Results since integrating Method

$2M+

in debt paid off across 100 financial institutions

20×

growth in monthly payments volume over the past year

80%

month over month retention

Ditch believes debt repayment should be easy

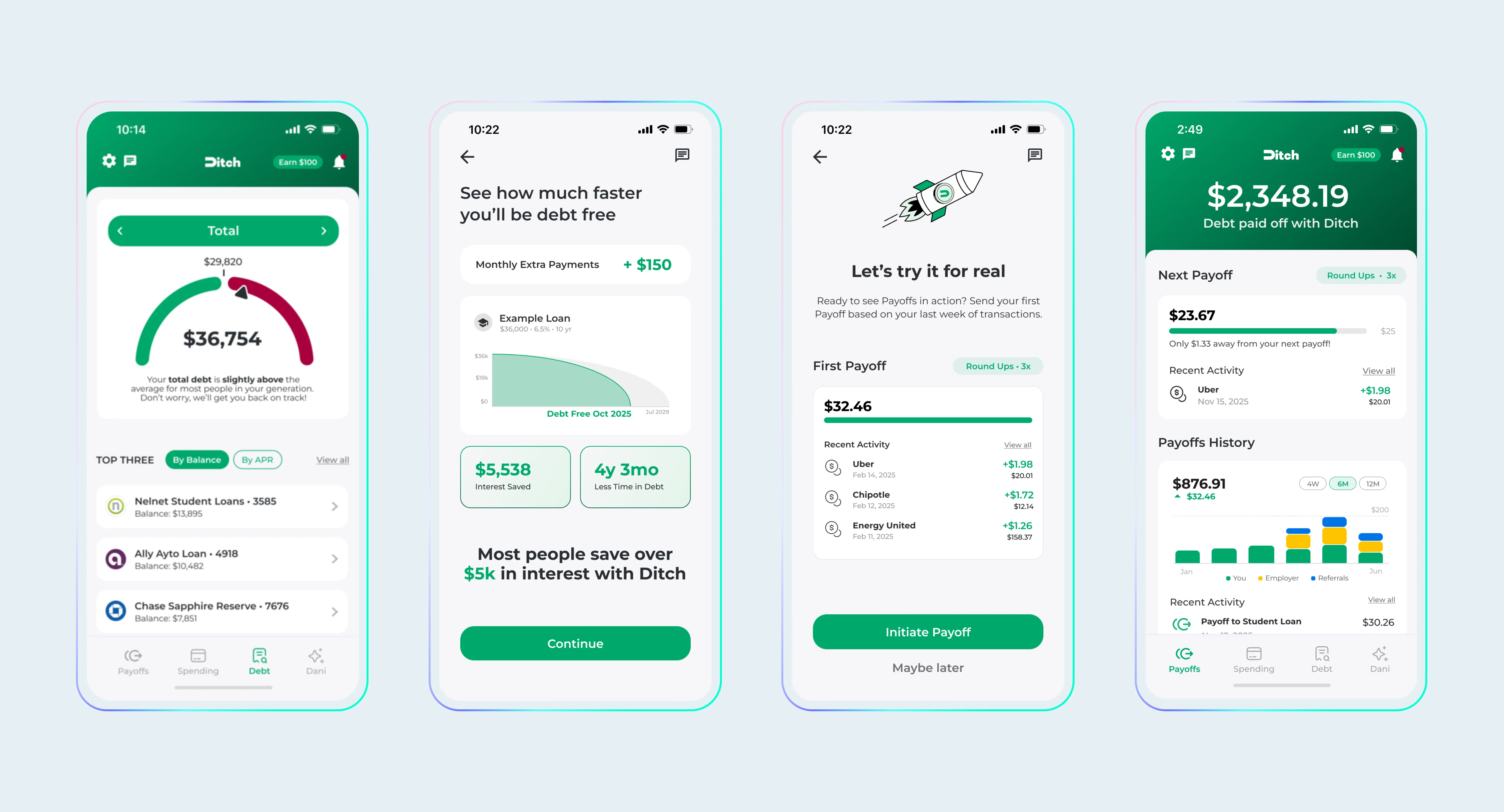

Ditch is a personal finance app built to make paying down debt simple and automatic.

Instead of asking users to manually move money or remember due dates, Ditch uses AI-powered coaching, automatic round-ups, and behavioral design to help users make progress without guilt, decision fatigue, or friction.

With Method, Ditch turned that vision into an end-to-end in-app experience, so users can connect their debts, see what they owe, and make repeat payments without leaving Ditch.

The result is a workflow that builds trust: 80% of users keep coming back to make small payments consistently, and those small actions add up over time.

Key launch facts

Product: Debt dashboard + embedded payments

Go-live: October 2023

Focus: Make debt payoff feel effortless through small, automatic payments

Adoption: Scaled from ~100 users at launch to supporting ~6,000 users today

The problem Ditch set out to solve

Before integrating Method, Ditch users ran into a familiar challenge: taking action required too many steps.

To support automatic debt repayment (including applying small dollar amounts and round-ups) users needed to manually connect multiple credit cards and loans. Each additional step increased friction and led to drop-off before users could see progress.

Without a simple way to handle both account linking and payments in one place, consistent adoption was hard to achieve. Users fell back on manual tracking, outdated data, or switching between portals to make payments.

The issue wasn’t interest or intent. Users wanted a more automatic way to pay down debt. Ditch didn’t need more insights or tracking — it needed a reliable way to handle connectivity and payments so repayment could happen quietly in the background.

What Ditch built with Method

With Method, Ditch built a debt management experience designed to help users keep repayment simple, repeatable, and embedded inside the app.

The experience starts when a user links their liability accounts through Method's embedded UX, Opal. Once connected, Method brings together credit cards, personal loans, and student debt into one unified view, with current balances, interest rates, and payment due dates.

From there, Ditch’s product experience guides users to prioritize debts, and Method enables payments to those liabilities directly from within Ditch. Over time, those small payments add up: the average user makes a ~$35 payment 4 times a month - all without logging into multiple banking portals or manually moving money.

What the Ditch teams says

“Partnering with Method was a no-brainer for us. Our goal at Ditch is to help users pay down debt faster and with confidence, but to do that, we needed reliable access to real-time liability data and a seamless way to move payments. Method gives us both — allowing us to automate repayment and deliver a simpler, more transparent experience for our users.”

Under the hood: the hard parts

Method's connectivity, real-time liability data, and embedded payments are the foundation of Ditch's repayment experience:

Instant account linking – users connect credit cards, personal loans, and student debt in seconds through Method's frictionless onboarding

Real-time balance updates – liability data refreshes automatically, eliminating reliance on outdated credit reports

Embedded payment rails – users can pay any connected liability directly from Ditch, with no need to leave the app or log into multiple portals

Complete coverage – Method's network spans 15,000+ financial institutions, ensuring users can see and pay virtually any debt

Behind the scenes, Ditch and Method's engineering and customer success teams collaborated to refine the user flow, ensure payment reliability, and scale the infrastructure from pilot to production—growing from roughly 100 users at launch to 6,000 today.

Early results

Since launching with Method, Ditch has:

Processed $2M+ in debt payments

$1.9M toward credit card debt

$200K toward student loans

$80K toward auto loans

Grown to 12k+ monthly payments

Maintained 80% month-over-month payment retention

But the numbers only tell part of the story. Ditch has become something rare in personal finance: a product users genuinely love.

Users aren't just trying Ditch; they're staying. And they're vocal about it. Over 30 organic, unprompted testimonials have appeared on TikTok from users celebrating their progress, with common themes like:

“It just happens.”

“I finally feel in control.”

“This makes debt feel possible.”

What users are saying

From the App Store:

“This app has been so helpful as a place to start paying off my debt. I was too overwhelmed to start, but this made it simple to pay it off little by little.”

“This makes it so easy to pay down debt without thinking about it. I’ve paid off three credit cards using small amounts of money I don’t miss.”

From TikTok (Maria Armas):

“I downloaded Ditch back in March, and it’s helped me pay off $3,200 so far. I didn’t even feel the money coming out of my account.”

What's next

Ditch is expanding its partnership with Method to build comprehensive debt planning and balance tracking, along with AI-driven repayment adjustments that adapt as user behavior and financial conditions change.

The goal is simple: make debt freedom not just possible, but inevitable.

Ditch’s #BuiltWithMethod Advantage

End-to-end in-app debt experience

Real-time liability coverage

Automatic repayment that runs in the background

Trusted infrastructure across 15,000+ financial institutions

Want to build your own automatic debt repayment experience?

If you want to ship a debt payoff experience, let’s talk. Book a demo today.